Conducting financial transactions on the fly has never been more effortless. Whether you are looking to settle bills, transfer funds, or make payments to online or retail merchants, the process is now modernized and user-friendly. It only requires a few clicks to shift money between accounts effortlessly.

The appearance of the unified payments interface (UPI) has played a crucial role in simplifying fund transfers. Spearheaded by the National Payments Corporation of India (NPCI), UPI payments were introduced to remove the complexities of online transactions.

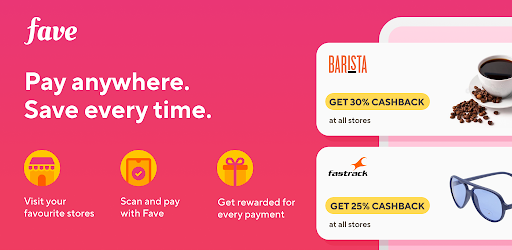

The upi payment is not only convenient but also cost-effective. Imagine being able to pay for your morning coffee while reaping the benefits of discounts, cashback offers and shopping rewards. That’s exactly what you can see with seamless UPI payments and discounts.

The power of UPI payments:

Before we dive into the world of savings, let’s understand what UPI payments are and why they are a game-changer. UPI is a real-time payment system. With the help of this, you can transfer money at once between bank accounts using your mobile phone. It’s like having your bank in your pocket. With UPI, you can say goodbye to the hassle of carrying cash and even the need to visit an ATM regularly.

While UPI is often used as a payment method within any online shopping app and other platforms. Users link their bank accounts to UPI, and then they can make secure payments through UPI when making purchases on various online shopping platforms and apps.

Seamless transactions:

One of the standout features of UPI payment is their seamlessness. You don’t need to worry about carrying bulky wallets or counting changes. Instead, you can scan a QR code with your mobile phone and make the payment. Whether you are at a Kirana store, a restaurant, a petrol pump, or any of the 30 million UPI-accepting merchants across India; the process remains effortless.

Discounts galore:

Now, let’s get to the exciting part – discounts. When you make an online payment using apps, you unlock a world of savings. Many big brands offer enticing discount coupon and vouchers that you can access through UPI transactions.

Cashback offers:

Besides discounts, UPI payments can also earn you instant cashback just like a shop and earn app. Imagine receiving a portion of your spent money back in your bank account. It’s a delightful surprise that UPI payments can bring. These cashback rewards can add up over time and turn your everyday transactions into significant savings.

Gift cards for extra savings:

But the savings don’t stop there. UPI payment apps offer an array of gift cards from over 200+ brands. These gift cards cover various categories, including food, fashion, travel, entertainment, and more. You can acquire online shopping rewards from your favorite brands all at your fingertips.

Secure and hassle-free transactions:

You might be wondering about the security of UPI payments. Rest assured, every transaction is secure, safe, and hassle-free. UPI payments require authentication for each online transaction. You can take work of your fingerprint or facial recognition to verify your identity. It makes it virtually impossible for unauthorized access.

Conclusion:

It’s a smart and effortless way to make your money harder for you while enjoying a hassle-free payment experience. So, why settle for less when you can unlock the full potential of your savings with UPI payments?