In times of economic uncertainty, crafting a tailored financial strategy becomes more essential than ever. Market volatility, rising inflation, and unpredictable income streams all contribute to a complex financial landscape. A personalized financial plan offers a focused approach to managing money, addressing both current needs and future goals.

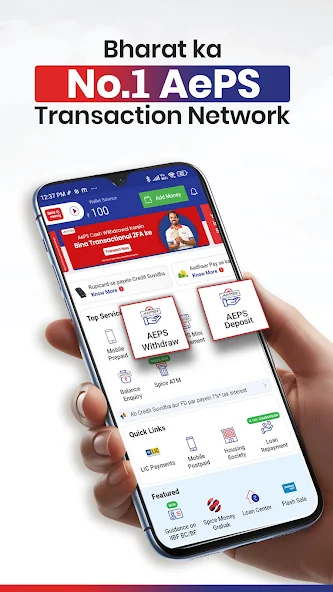

As individuals adapt to these changes, financial flexibility has become a key priority. Tools like loan personal and mobile loans are increasingly used as part of adaptive financial planning. These options provide access to short-term credit while allowing for better control of unexpected financial needs.

Understanding how to approach financial planning in an unstable environment involves assessing risk, rebalancing priorities, and aligning decisions with realistic objectives.

Understanding the Role of Personal Financial Planning

Why Personalization Matters

Every individual has a unique financial situation influenced by income, liabilities, family responsibilities, and future aspirations. A personalized financial plan considers these factors to create a structured yet adaptable roadmap.

Instead of applying general financial advice, personal planning aligns with specific circumstances, making it easier to stick to a plan, adjust it when needed, and maintain long-term focus. This kind of clarity is crucial in a volatile market, where unpredictable shifts can disrupt rigid strategies.

Components of a Strong Financial Plan

A well-rounded plan typically includes:

- Budgeting: Understanding cash flow and controlling spending

- Savings Strategy: Building reserves for emergencies and short-term needs

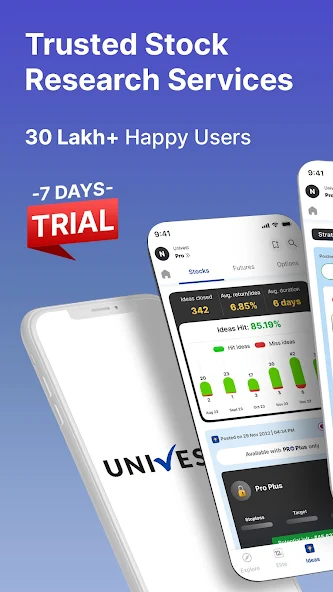

- Investment Planning: Managing long-term wealth creation while evaluating market risks

- Debt Management: Organizing repayment schedules and interest priorities

- Contingency Planning: Preparing for job loss, medical emergencies, or inflation spikes

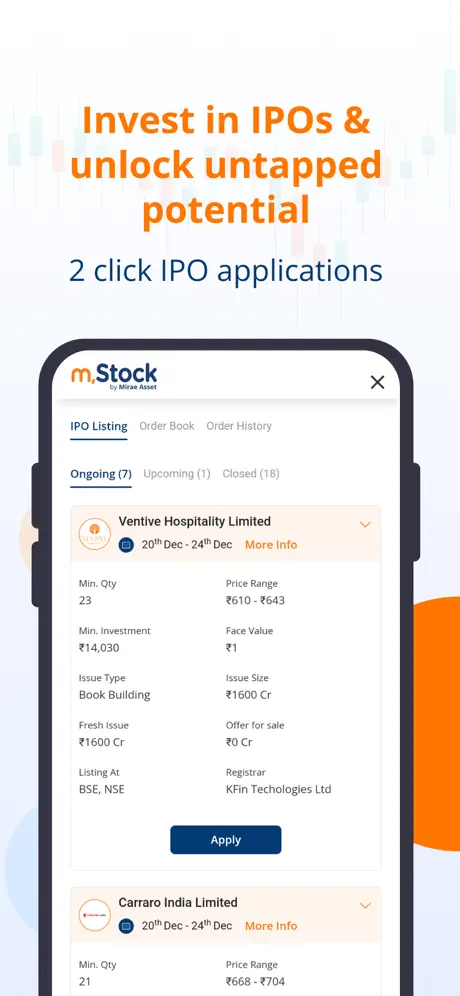

Loan products such as mobile loans and loan personal can support contingency plans by offering fast financial relief during periods of cash flow disruption.

Adapting to Market Volatility

Managing Risk in Uncertain Times

Volatile markets bring sudden changes that can affect employment, interest rates, and investment returns. Personalized planning begins by assessing your risk profile. Are you comfortable with financial fluctuations, or do you need stability?

Lower-risk options might involve prioritizing fixed-income instruments and holding higher cash reserves. In contrast, younger individuals or those with secure incomes may maintain more aggressive investments with long-term growth prospects.

Flexibility in borrowing, especially through loan personal options, allows for short-term liquidity without compromising future financial stability. Mobile loans, when used carefully, serve as a helpful supplement for temporary gaps in earnings or sudden costs.

Re-evaluating Priorities

In a fluctuating economy, financial goals often need revisiting. An approach that once emphasized travel or luxury purchases may now shift toward savings and homeownership. Personalized planning enables this realignment without starting from scratch.

Monitoring your goals regularly ensures they remain relevant. For example, an annual review of spending patterns, investments, and credit use can prevent long-term setbacks. Mobile loans offer a bridge for goals that require immediate attention without derailing long-term savings.

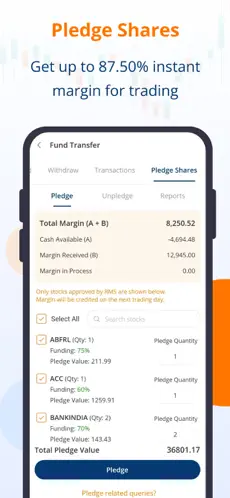

Strategic Use of Credit

Integrating Loans into Financial Planning

Credit is a powerful tool when used strategically. Rather than viewing loans as a burden, integrating them into your plan helps you manage cash flow while protecting assets.

Loan personal options provide unsecured credit that can be used for diverse needs such as education, relocation, or consolidating higher-interest debt. The key lies in understanding repayment capacity and how the loan fits into your monthly budget.

Similarly, mobile loans offer convenience and speed, making them ideal for urgent expenses like medical emergencies or repair costs. When aligned with your financial plan, these tools act as buffers rather than liabilities.

Avoiding Overexposure

The convenience of credit also requires discipline. Avoid using mobile loans or any credit tools to fund ongoing lifestyle costs or speculative investments. Personalization ensures borrowing is tied to planned, calculated needs, not emotional decisions.

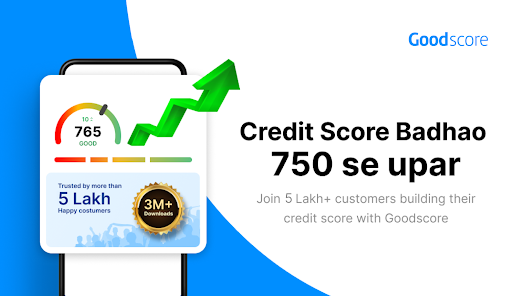

Reviewing your credit regularly and maintaining a balance between income, expenses, and repayments helps maintain financial resilience even during downturns.

Savings and Emergency Funds

Creating Financial Safety Nets

An essential component of any financial plan is an emergency fund. This reserve protects you against income disruption and unexpected expenses, reducing the need to borrow under stress. However, in cases where additional support is needed, loan personal and mobile loans serve as secondary tools, not first lines of defense.

Ideally, your emergency fund should cover 3 to 6 months of living expenses and be stored in a liquid, accessible account. Personalized planning can determine the exact size and structure of this fund based on your income stability and obligations.

Long-Term Wealth and Retirement Planning

Staying on Track Despite Volatility

Volatile markets often tempt individuals to make short-term decisions that compromise long-term gains. Personalized plans maintain a focus on retirement and wealth accumulation even when markets shift.

Investments should be aligned with your age, goals, and risk tolerance. For instance, diversified portfolios and retirement accounts allow for long-term growth while softening the impact of sudden downturns.

Rebalancing investments periodically and adjusting contributions according to income changes ensures progress toward financial independence, even in turbulent conditions.

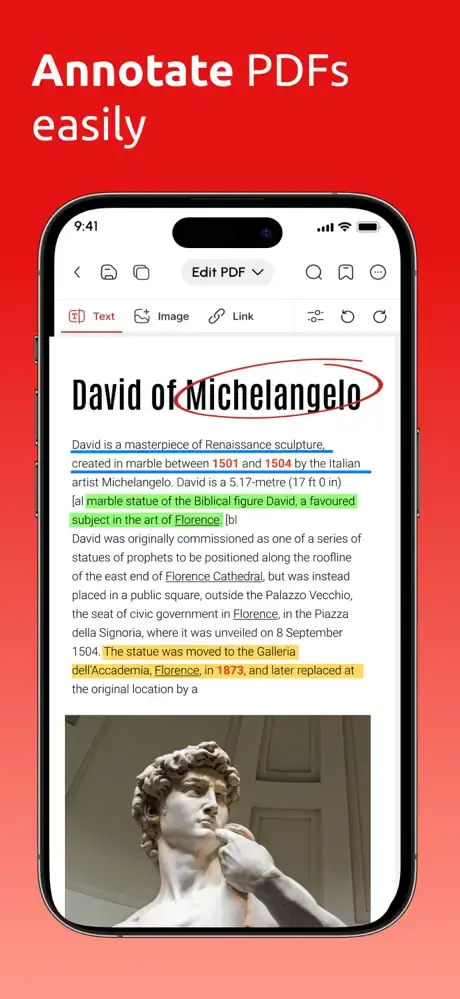

Financial Literacy and Continuous Improvement

Building Knowledge and Confidence

Understanding financial principles empowers individuals to make informed decisions. Whether managing a mobile loan, tracking debt, or evaluating investment options, financial literacy plays a critical role in achieving stability.

Regularly updating your knowledge through credible resources and seeking professional advice where necessary are part of personalized planning. It transforms your financial journey into a proactive process rather than a reactive one.

Conclusion

Economic volatility is unavoidable, but its impact can be managed through thoughtful planning and deliberate action. A personalized financial plan helps you adjust to change, protect your goals, and maintain peace of mind.Incorporating flexible tools like loan personal and mobile loans into your broader strategy ensures you’re prepared for unexpected costs without compromising long-term priorities. These instruments, when used with care, provide vital support in maintaining balance during financial storms.