Financial emergencies can strike unexpectedly in today’s fast-paced world, leaving us feeling overwhelmed and stressed. Those days of pawn loan are long gone.

Thankfully, technology has brought about a convenient solution: an online loan app. These loans provide immediate access to funds, empowering individuals to overcome financial hurdles without the hassle of traditional lending processes.

In this blog post, we will explore how online loans app can unlock financial freedom at your fingertips, offering a lifeline during times of need.

Convenience and Accessibility:

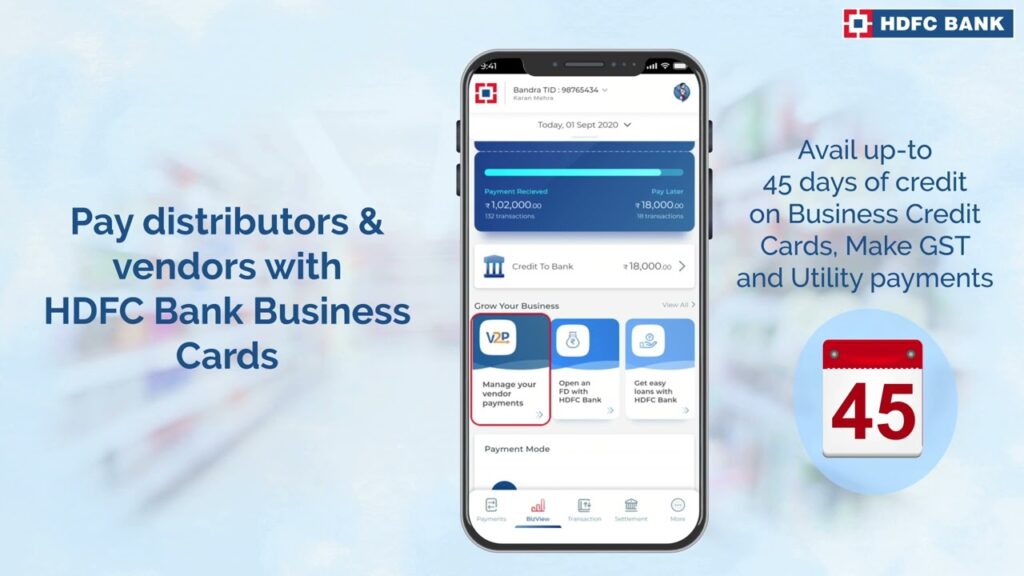

One of the primary advantages of online small loans is their convenience. Unlike traditional loan applications, which often require multiple visits to the bank and lengthy paperwork, easy loan app allow you to apply for a loan from the comfort of your home.

With just a few clicks, you can complete and apply for instant loan electronically. This streamlined process saves precious time and effort.

Furthermore, small online loans provide unparalleled Accessibility. Financial institutions now understand that emergencies take time for business hours, and the best loan app in India offers 24/7 service. Whether it’s early morning or late at night, you can access funds whenever needed, making small loans online a reliable solution for unexpected expenses.

Fast Approval and Disbursement:

Waiting for days or weeks for loan approval can be nerve-wracking, especially when time is of the essence. urgent loan app addresses this concern by prioritizing quick approval and disbursement.

With advanced algorithms and digital processes, student loan app can assess your application swiftly, often providing instant approvals.

Once approved, funds are typically disbursed directly into your bank account within hours or minutes, depending on the lender. This rapid turnaround time is a game-changer, allowing you to tackle financial emergencies promptly and avoid further complications.

Flexible Borrowing Options:

Small online loans offer flexibility in borrowing options, catering to diverse financial needs. Whether you require a small amount for a short-term expense or a larger loan for a more significant investment, online lenders can provide tailored solutions to meet your requirements.

Additionally, many online lenders offer flexible repayment terms, allowing you to choose a repayment schedule that aligns with your financial situation. This ensures that loan repayment doesn’t become an additional burden, allowing you to manage your finances effectively. They also offer different tools like gold loan calculator, EMI calculators, etc.

Security and Privacy:

With advancements in digital security measures, online lending platforms have become increasingly secure. Reputable lenders employ encryption technology and stringent data protection protocols to safeguard your personal and financial information. These measures ensure that your data remains confidential and protected throughout the loan application process, giving you peace of mind.

Conclusion:

Loan Finance app online have revolutionized the lending landscape, providing a convenient, accessible, and efficient solution for those in need of quick financial assistance. With ease of use, rapid approval, flexible borrowing options, and robust security measures, these loans empower individuals to navigate unexpected financial challenges effectively. So, the next time you face an unforeseen expense, remember that financial freedom is just a few clicks away with small loans online.

Gone are the days of lengthy paperwork and waiting in queues at traditional banks. Small online loans empower individuals to control their finances by providing immediate access to funds with a few simple clicks. Whether covering unexpected medical expenses, repairing a car, or managing temporary cash flow gaps, these loans offer a flexible and accessible solution.