Applying for a loan no longer requires visiting multiple branches, filling in long forms, or waiting for weeks to hear back. With today’s digital tools, the process is much faster and can be done entirely from home. The term Online Loan Apply simply refers to submitting a loan request through a secure online platform or mobile application. Whether it’s for education, medical needs, or a new home purchase, applying online allows borrowers to save time and track their application status instantly.

For those looking to buy a property or renovate an existing one, a Housing Loan App can simplify the entire journey. Such applications are designed to help you check eligibility, calculate repayments, and complete documentation without physical visits. This explains each step of how to Online Loan Apply for any purpose and what to keep in mind for a smooth process.

Understanding the Online Loan Apply Process

What Is an Online Loan Application?

It is a digital method of submitting your loan request to a bank or financial institution. Instead of carrying physical paperwork, you fill out forms, upload required documents, and submit everything through a secure portal or app. Once completed, the lender reviews your details and responds with approval, rejection, or a request for more information.

Why It’s Different from Offline Applications

The primary difference lies in convenience and speed. Traditional applications may involve standing in queues, arranging paper files, and attending multiple in-person meetings. With online applications, most of these steps are replaced by quick form submissions and instant communication channels.

Steps to Online Loan Apply Successfully

1. Identify Your Loan Purpose

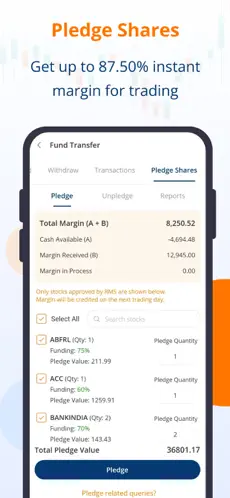

Before starting, determine why you are applying. This purpose will guide you in choosing the right loan type—personal, housing, education, or business. If you’re considering property purchase or improvements, using a Housing Loan App can help you compare repayment terms and interest rates tailored for housing needs.

2. Check Your Eligibility

Every lender has basic criteria for loan approval. These may include income level, employment type, existing debts, and repayment history. Reviewing these requirements beforehand increases your chance of approval.

3. Prepare the Required Documents

Commonly needed documents include:

- Proof of identity

- Proof of address

- Income statements or salary slips

- Bank account statements

- Property-related documents for housing loans

Uploading these in clear, legible formats is crucial for a smooth verification process.

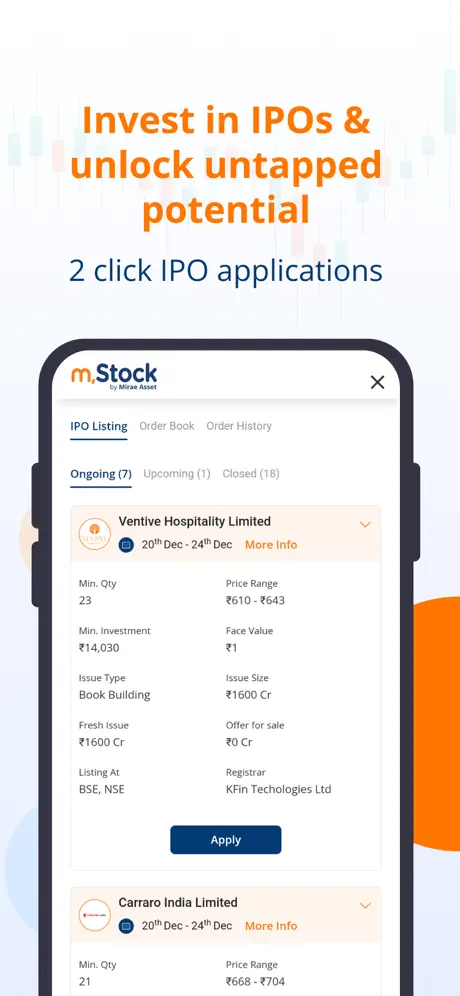

4. Choose the Right Platform or App

Select a reputable online platform or application that supports your loan type. For housing loans, a Housing Loan App provides tools such as EMI calculators and loan tracking features.

5. Fill Out the Application Form

Be accurate and complete. Any errors or missing details can delay the process. Include correct contact details, employment history, and income information.

6. Submit and Track

After submission, keep an eye on your application status through email updates, app notifications, or the lender’s website.

Key Benefits of Applying for Loans Online

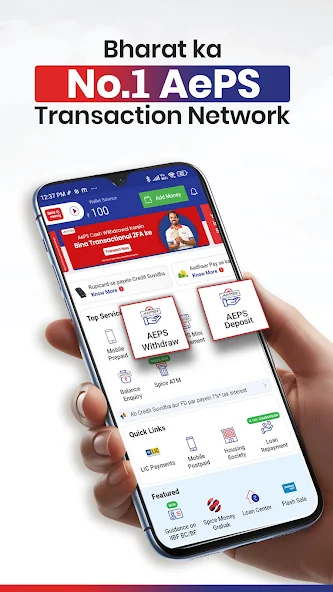

Convenience

Applications can be made anytime, anywhere, without time constraints or travel requirements.

Faster Processing

Online systems often allow instant verification of documents, speeding up approval times.

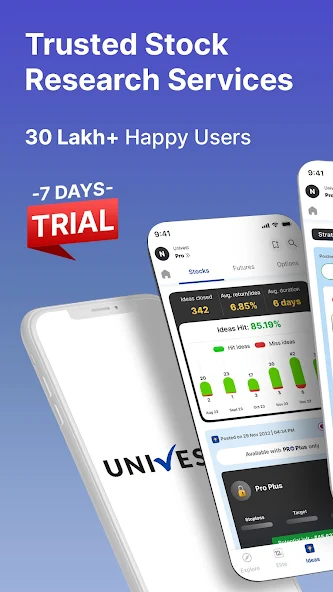

Better Comparison

Digital platforms make it easy to compare multiple loan offers side by side.

Secure Storage

All documents are stored digitally, reducing the risk of losing important papers.

Using a Housing Loan App for Property Needs

A Housing Loan App is specifically built to handle all aspects of property-related financing.

Some advantages include:

- Eligibility Check: Find out how much you can borrow within minutes.

- EMI Calculators: Estimate monthly repayments based on loan amount, interest rate, and tenure.

- Document Uploads: Send property papers and personal details without visiting the branch.

- Status Tracking: Monitor approval stages and disbursement timelines.

For anyone looking to purchase a home, renovate an existing one, or refinance an old loan, these apps remove much of the manual work from the process.

Common Mistakes to Avoid When You Online Loan Apply

Providing Incomplete Information

Even small errors in your application form can lead to delays or rejections.

Ignoring Credit Health

Your repayment history plays a big role in approval. Check your credit score before applying.

Not Comparing Offers

Different lenders have different terms. Comparing options ensures you select the most suitable one.

Overestimating Repayment Ability

Borrow only what you can comfortably repay. Use calculators to check monthly obligations.

Tips for a Smooth Online Loan Apply Experience

- Use Reliable Internet: Interruptions during form submission can cause errors.

- Keep Documents Ready: Pre-scan and save required files in acceptable formats.

- Read Terms Carefully: Understand repayment terms, interest rates, and fees.

- Respond Promptly: If the lender requests more information, reply quickly to avoid delays.

- Check App Security: Ensure the platform or app uses encryption for data safety.

The Future of Online Loan Applications

Digital lending is expected to become the standard approach in the coming years. With the rise of mobile banking and automated verification systems, applying for loans will become even more streamlined. Features like instant credit checks, AI-driven approval systems, and paperless documentation are making the process faster and more accurate.

For housing-related needs, advancements in Housing Loan App technology will likely include property valuation tools, legal document verification, and integration with government property databases.

Conclusion

Applying for loans online has become a practical solution for many financial needs. The Online Loan Apply process offers speed, transparency, and ease of use, making it suitable for both urgent and planned expenses. Whether you need funds for education, medical treatment, or buying a new home, the process can be managed entirely from your phone or computer.

For property-related financing, a Housing Loan App is particularly useful, giving borrowers access to instant calculations, eligibility checks, and status tracking. By following the steps outlined in this guide—checking eligibility, preparing documents, and using secure platforms—you can complete your application without unnecessary delays.

In a world moving rapidly toward digital solutions, mastering the Online Loan Apply process ensures that you can access funds efficiently and with confidence, regardless of the purpose.