Online stock trading has evolved into a common approach to wealth-building in the digital era. Thanks to technology and the growth the trading apps India provides, even first-time investors may purchase and sell shares with a few taps on their phones. However, this ease can also result in common errors that might cause the loss of fresh traders’ money and drive down the effect.

Common Mistakes To Avoid in Online Share Market Trading

Knowing these traps will enable you to make wiser decisions in share market trading, regardless of your level of experience or goal of strategy-sharpening.

1. Lack Of Appropriate Research

One of the most common blunders in online stock trading is starting without any actual knowledge of the market. Many people join the share market without performing research, depending on advice from friends, social media buzz, or the newest trends. Researching firms, grasping their financial situation, and tracking industry developments before investing are absolutely vital.

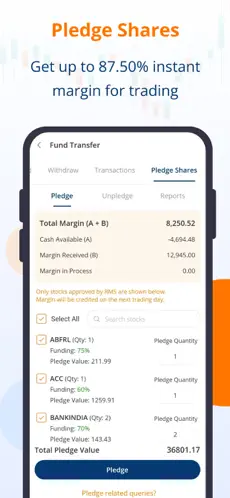

2. Selecting The Incorrect Application

Not every trading app available in India is suitable for every investor. Certain platforms may have limited functionality, hidden costs, or bad user interfaces. Choosing the correct share market trading app is vital regardless of your level of experience with trading. Search for apps with minimal brokerage, real-time data, intuitive dashboards, and robust customer support.

3. Overtrading Without A Plan

Many times, overtrading—buying and selling regularly without any strategy—occurs when utilizing a free trading app. This kind of activity can be emotionally motivated and usually results in unneeded losses. One should follow a well-defined plan and keep to it rather than chasing rapid gains or reacting haphazardly to temporary market swings.

4. Denying Control of Risk Management

In share market trading, a golden rule states that you should avoid investing money you cannot afford to lose. Not controlling risk is among the fastest ways to lose money. Never put all your money into one stock; diversify your investments; use stop-loss orders. Effective trading rests mostly on good risk management.

5. Not Maximizing App Features

Powerful facilities, such as real-time stock notifications, market news, instructional aids, and even demo accounts, abound in any of the contemporary share market trading app. Many consumers, meanwhile, do not maximize these features. Knowing how to use your free trading software fully can equip you with a competitive edge and enable you to make better judgments.

6. Unreasonably High Standards

New traders sometimes expect overnight success, particularly after learning of others making large gains from online stock trading. Sustained trading success calls for time, knowledge, and patience. Give top priority to long-term objectives rather than transient benefits.

Conclusion

India provides many trading programs, which makes entering online stock trading simpler than before. To really succeed, though, one must avoid typical errors, such as lack of research, bad app choices, overtrading, and risk-ignoring behavior. Knowledge, discipline, and strategy are your finest tools, whether you use free trading software or a commercial one.

Spend some time learning, make intelligent investments, and use an appropriate share market trading app to help you travel toward financial expansion.