Maintaining good credit is essential in the modern-day era, and one of the key elements to achieve that is making on-time credit card payments.

But what if your account savings are low, and you face a tough time paying your credit card debt.

In the era of UPI payments, it is quite normal to overspend and fall short of funds.

This article will list a few tips and tricks to help you effectively manage your credit card debt without punching a hole in your pocket.

Call Your Credit Card Company

Sometimes, you won’t have enough account savings to be able to clear your credit card bill due to some genuine reasons. In such cases, do not drop a call to your credit card company to explain your situation; Ask them if they can do anything to help you.

If you have a good credit history, they might offer a temporary payment reduction or give an extension.

Create a Good Budget

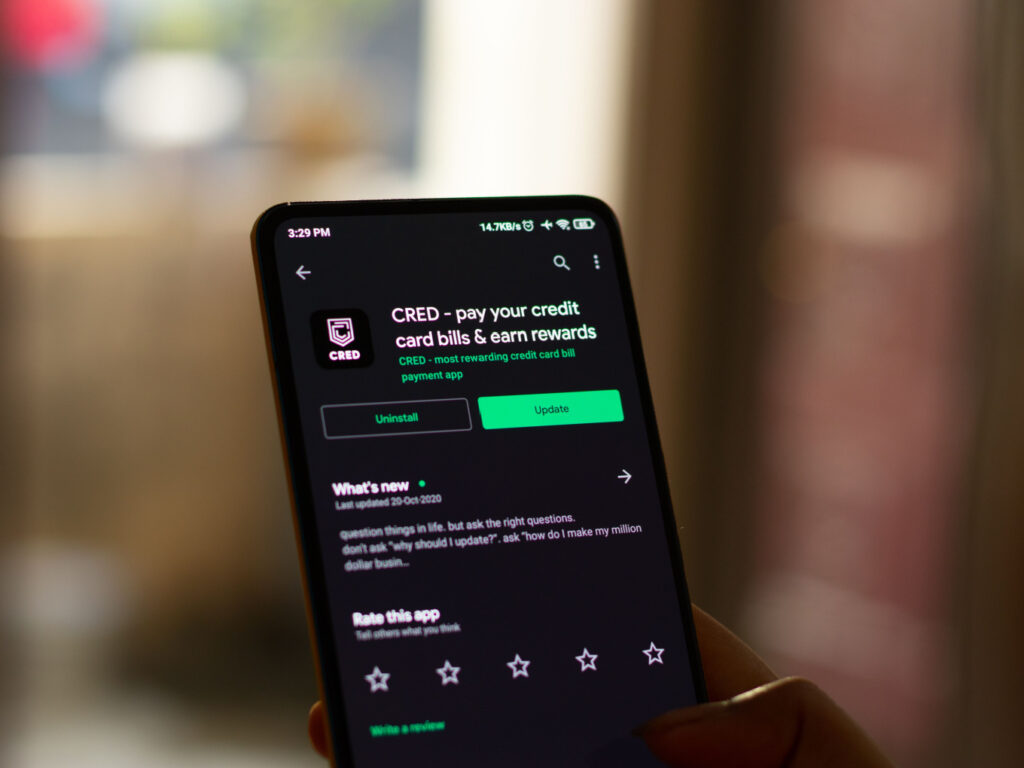

To be able to pay your credit card bills effectively, you must have enough savings by the end of every month. Therefore, it is wise to create a budget plan so you won’t be spending your money recklessly. Keep track of all your essential expenses, like groceries and utilities, taxes, etc., using various savings apps. These applications are excellent tools to help you create and stick to a budget.

Pay a Little Extra Sometimes

One of the most essential factors to keep in while paying your credit card bill is to never let the interest rate go high.You can be tempted to pay only the minimum credit card bill every month, but so will accrue interest rates and ultimately cost you more every day.Always try to pay the full amount. In some cases, when you have extra funds in your savings account, use your UPI app to pay the entire amount or at least pay more than the minimum. This will help to avoid a dip in your credit score.

Use the Debt Snowball Method

The debt snowball method is a savings strategy that will help you repay your existing credit debt. Here, you have to focus on first repaying the loans with the least balance amount, irrespective of their interest rates. Doing so will help you clear a few loans, which can be quite motivating.

Debt Avalanche Method

Similar to the earlier method, the debt avalanche method is a debt payoff strategy where you prioritize the credit card bills with the highest interest rates first. This will be highly beneficial if you are looking for maximum savings on the interest rate.

Final words:

If you don’t know how to manage your credit payments, you will run low on account savings to pay the debt. This is why you must make a detailed budget plan and employ smart debt payment strategies to stay on top and never miss a payment. Also, try to make regular payments to maintain a good and high credit score.